If you sell to the federal government, you’ve felt the ground shift under your feet. In 2025, the current administration put real muscle behind a long-running idea: buy more things the same way, through fewer, larger vehicles run by GSA, and stop letting every agency invent its own contract unless absolutely necessary. That push—contract consolidation—is already changing where opportunities appear, how they’re competed, and who gets invited to play. For small businesses, FY26 won’t be business as usual; it will reward firms that reposition quickly—mapping opportunities to the right channels, partnering wisely, and bidding with more discipline.

First, what “consolidation” actually means

Let’s demystify terms that get tossed around interchangeably.

- Consolidation is defined in the current FAR Part 2 but it is not defined in the new “overhauled” FAR nor is it even mentioned in the new FAR Companion. Same for bundling.

- Consolidation and bundling as described in those sections is very different from consolidated procurement (taking actions from across agencies and placing them with one agency to determine how buying is done.

Contract consolidation reduces the number of places a buyer goes to shop. Bundling can raise the bar to a height that fewer small primes can clear. Neither is new. What’s new is the speed and scope.

What changed in 2025—and why it matters now

Three signposts define the new landscape:

- Executive Order 14240 (March 20, 2025) centralized the procurement of common goods and services at GSA to eliminate duplication, cut cost, and standardize buying.

- OMB guidance (July 2025) directed agencies to: (1) use existing government-wide and Best-in-Class contracts first, and (2) shift more procurement functions to GSA. The memo also previewed FAR changes that will require approval when agencies want to create their own vehicles instead of using an existing one.

- GSA implementation has followed quickly, including policy updates and deviations that align consolidation, bundling, and substantial bundling requirements and emphasize small business considerations in planning and market research. Expect more category management direction, more “use it or justify it,” and fewer one-off agency vehicles.

Put together, these moves shift demand toward a smaller number of big, centralized channels—GSA Schedules, Best-in-Class and other government-wide contracts, and agencywide multi-award vehicles that survived the cut. The opportunity flow doesn’t stop; it migrates.

The practical effects small businesses will see in FY26

Here’s how consolidation shows up on your capture radar—starting now:

- Fewer brand-new agency IDIQs and BPAs. Buyers will lean first on what already exists. You’ll see more orders and task-order competitions under GSA-run vehicles and fewer full-and-open new stand-alone contracts.

- More cancellations or re-routes. Some agency-specific solicitations will be cancelled, then re-issued as orders on an existing BIC or government-wide vehicle. If your “must-win” disappeared in late FY25, you’ve already felt this.

- More mandatory-use expectations (or at least higher justification hurdles) when agencies don’t use an existing vehicle. That raises predictability for where work appears, but it also concentrates competition.

- Prime seats become gating assets. Without a prime spot on the right vehicles, you’ll need strong teaming strategies—fast—to access the work. That’s not new, but the leverage shifts more to holders with healthy past performance and ordering throughput.

- Longer, more structured capture cycles. Pre-RFI sensing, early market research participation, and influencer mapping matter more when the “real” competition happens at the task-order level where timelines compress.

- Different small business math. Consolidation can deliver savings to government but may reduce the number of discrete, small-firm-sized awards. Some pathways improve (subcontracting, JV/mentor-protégé), others narrow (micro set-asides on stand-alone buys). Plan accordingly.

- The value of outreach to category managers and small business offices is uncertain. Your relationship map should include GSA category managers, agency OSDBUs, and vehicle program offices. It’s good to know who’s who (and what they do) when you hear names dropped in conversations. But this administration is still cutting Small Business Specialist positions, so as we move into 2026, those who remain are likely to have limited bandwidth to help vendors. And Category Managers don’t make buying decisions.

Myth vs. reality under consolidation

- Myth: “Consolidation kills small business opportunities.”

Reality: It changes where and how you win. Subcontracting plans, teaming, and mentor-protégé/JVs can expand the pie for capable smalls, even as prime slots concentrate. FAR 7.107 still requires analysis and public notice to mitigate harm. - Myth: “If I just get a GSA Schedule, I’m set.”

Reality: A Schedule is an entry badge, not a win button. You still need relationships, visible past performance, a differentiated offer, and a focused pipeline to compete for orders on the relevant lanes. - Myth: “My agency loves me—they’ll keep using our stand-alone contract.”

Reality: The policy tide runs the other way. Program offices may prefer your contract, but they’ll face pressure (and new approval gates) to use existing government-wide solutions. Build your bridge to those channels now. - Myth: “Consolidation only hits commoditized buys.”

Reality: The early push is strongest for common goods and services, but guidance also contemplates centralizing broader procurement functions over time. Expect spillover into services that look “common enough” at scale.

A small business playbook for FY26

Here’s a practical sequence you can run in the next 60–90 days to stay in the game and grow:

- Map your revenue to the new contract vehicles. List your top three agencies, top five programs, and top ten customers. For each, identify the current and likely future contract vehicles (e.g., specific GSA Schedule SINs, Best-in-Class contracts, and agency-unique vehicles migrating to GSA). Flag gaps where you lack access.

- Decide whether a GSA Schedule is part of your strategy. If your buyers are shifting orders to GSA Schedules—and you can price, market, and deliver competitively at scale—pursuing or optimizing a Schedule can unlock access. If your buyers are consolidating onto other government-wide contracts, the better move may be teaming with existing holders. (We’ll go deeper on this decision in our companion post.)

- Build a “gatekeeper” partner matrix. For each target channel, identify prime holders with: (a) throughput in your NAICS/SINs, (b) gaps you can fill, and (c) track record — ideally verifiable with agency insiders — as top performers. Rank them by overlap and build two-way value propositions. Your job: make it easy for primes to say “yes” by bringing end-user intimacy and low-risk delivery.

- Engage earlier in market research. Many consolidation choices are shaped before any draft RFP hits the street. Track RFI/RFC activity on the vehicles you’re targeting. Submit crisp capability statements tailored to the mission, with concrete past performance and teaming constructs that reduce buyer risk under the chosen channel.

-

Tune your pricing and packaging for task-order competition.

Orders on centralized vehicles move quickly and can be price-sensitive. Design repeatable, modular offers; establish rapid, well-documented Basis of Estimate (BOE) processes; and prep ready-to-use compliance matrices for your focus vehicles. Your BOE is simply the story of how you built your pricing — the labor categories, hours, rates, escalation assumptions, and indirect costs behind your numbers. Contracting officers on consolidated vehicles are under more pressure to justify award decisions, so if your BOE is vague or inconsistent, you risk being knocked out early even if your overall price looks competitive. Companies should check competitor’ GSA pricing as a baseline before submitting their offer to be certain they are in the optimum range because changes can take 6-9+ months to make. In the meantime, offer discounts off pricing if given the opportunity (which they won’t always get). Agencies often choose companies to compete based on a cursory review of pricing. - Use Mentor-Protégé and JVs strategically. When prime seats are scarce, structured teaming gives you a prime-like path on the right vehicles without waiting years. If you’re a small business in a joint venture with a large business, a JV under the aegis of a Mentor-Protégé agreement is one of the best ways to minimize the risk of protests related to accusations of “Ostensible Subcontracting”. Keep the JV genuinely integrated—shared systems, co-branded delivery, and real performance plans—or it won’t persuade evaluators.

- Invest in relationships with SB offices and category managers. Educate OSDBUs on how your participation preserves small business value under consolidation. Share measurable benefits (cycle time, innovation, mission outcomes) and propose realistic set-aside approaches within vehicles (e.g., small business tracks, socioeconomic pools).

- Defend and diversify your past performance. Concentration on a few vehicles increases the impact of your project success stories and order-level results. Keep an eye open for opportunities to generate “wins you can use” throughout your contract performance. Then turn each delivery into visible proof—references, case briefs, and outcomes—optimized for your next capture.

- Revise your pipeline. Rebuild FY26 targets around the contract vehicles as much as the customers. Be ruthless: remove stagnant stand-alone prospects with truly likely task orders. Use a three-horizon view: (A) near-term orders on vehicles where you already have access; (B) mid-term teaming/JV pursuits to gain access; (C) long-term positioning for the next on-ramp or recompete.

- Communicate the change to your internal team. Consolidation demands tighter cross-talk between BD, pricing, contracts, and delivery. Align capture gates with vehicle timelines and educate everyone on what “good” looks like now: faster teaming decisions, earlier shaping, more rigorous bid/no-bid discipline.

Two quick scenarios to make it concrete

Scenario 1: The vanishing recompete.

Your incumbent task order sits on an agency-specific IDIQ. Mid-capture, the recompete gets cancelled and re-routed to a Best-in-Class vehicle you don’t hold. Old playbook: wait for a protest or hope it reappears elsewhere. New playbook: immediately pivot to three primes with throughput on that vehicle, bring them your user intimacy and a delivery improvement plan, and negotiate a meaningful workshare that preserves your key past performance.

Scenario 2: The Schedule that won’t move.

You spent months getting a GSA Schedule but haven’t booked orders. Discover why: Are your buyers actually using a different government-wide vehicle? Are your SINs misaligned? Is your pricing out of market? Fix the mapping, adjust your offer to what buyers are ordering, build relationships with the contracting centers that place those orders, and pursue small, fast, winnable tasks to create momentum.

Risk management: what to watch and how to hedge

Policy evolution. FAR and agency policies will keep adapting as OMB and GSA operationalize consolidation. Track updates from category managers and vehicle program offices, and expect more “use existing first” nudges in planning and approval processes.

Small business impact. Even supporters of consolidation acknowledge trade-offs that could squeeze small primes if not actively managed. Watch how agencies implement notice and mitigation steps under FAR 7.107-5, and press for set-aside pools and realistic subcontracting plans at the vehicle level.

Competition density. As more demand flows to fewer channels, order-level competitions can get crowded. Differentiate with credible teaming, user-level insight, and past performance that speaks to the specific mission.

Cashflow and pricing pressure. Centralized channels can accelerate ordering but compress margins. Model “best-and-final” scenarios and protect your balance sheet.

Organizational change within the Agencies. Functional centralization means some buying decisions move to different offices (or to GSA) than before. Update your Players & Layers® map accordingly, including the people who influence channel selection.

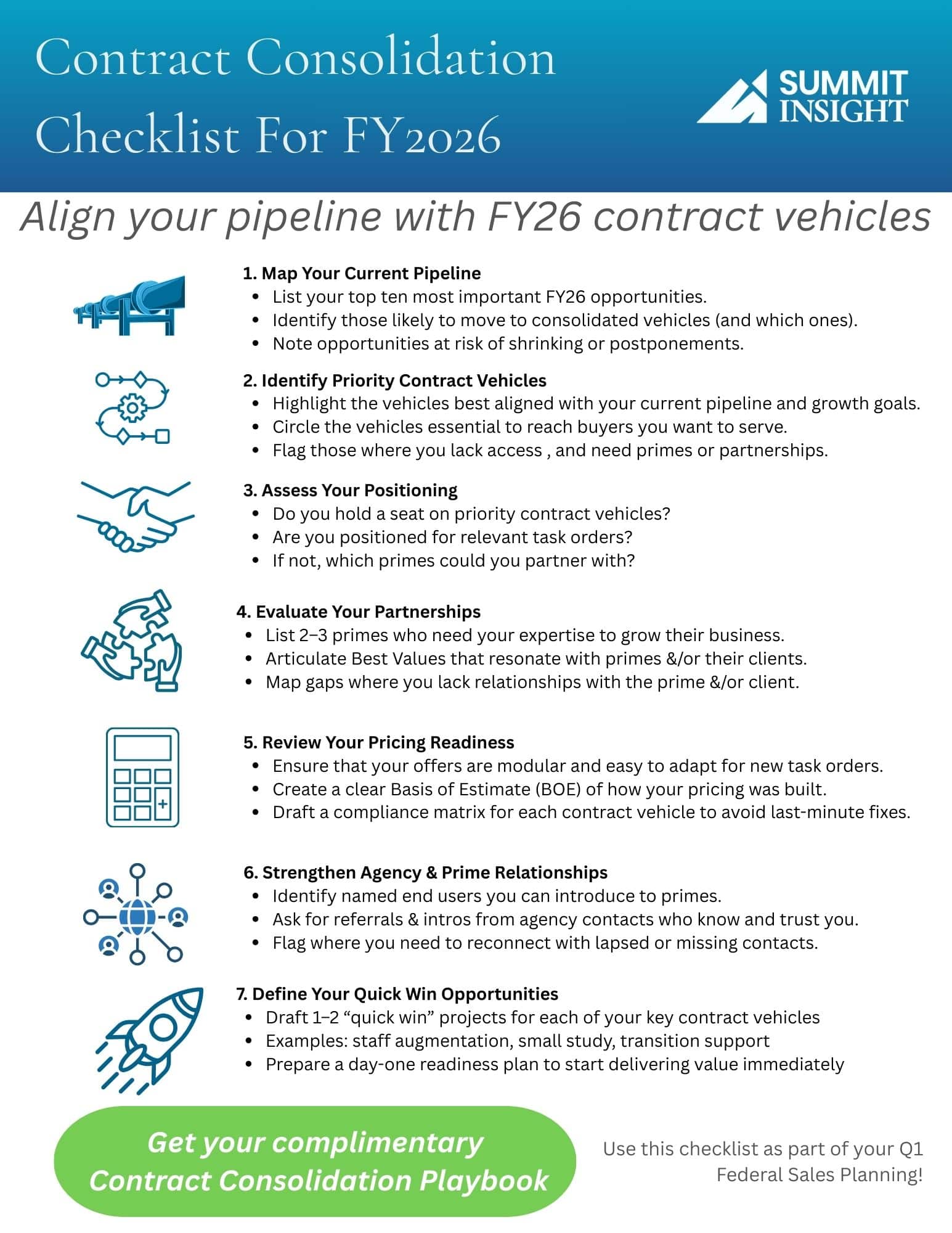

Download the Contract Consolidation Checklist

Before you move forward, grab this free Contract Consolidation Checklist — a one-page tool to help you:

- See how your pipeline lines up with the top FY26 contract vehicles

- Spot gaps in your current strategy

- Take the first steps to reposition

Go Deep: the Contract Consolidation Playbook

Ready for the full strategy? The Contract Consolidation Playbook takes you further with guided steps, examples, and practical frameworks you can apply across your top accounts. Use it to build a sharper capture plan and win work even as the rules shift.

FAQs we’re already hearing

Does consolidation mean fewer set-asides?

Not automatically. Agencies still have small business goals and responsibilities. But some work that used to be competed as stand-alone set-asides may show up as tracks or pools within a centralized vehicle—or as subcontracting plan commitments on orders. Your strategy should cover both prime and sub paths, and you should actively engage SB offices about how to preserve small business value at the vehicle level.

Do I need a GSA Schedule now?

Maybe. If your buyers are clearly shifting orders to Schedules in categories you can serve competitively, a Schedule can be a smart move. If your buyers are consolidating into other government-wide vehicles where you won’t have a prime seat soon, you may get more traction teaming with holders while you prepare for the next on-ramp. (We’ll unpack this in our follow-on post, “Should You Get a GSA Schedule in FY26?”)

How fast is this going to happen?

It’s already happening. OMB’s guidance and GSA’s follow-through accelerate the trend, and some agencies have already cancelled or redirected vehicles to consolidate demand. Expect 12–24 months of active migration as policies, FAR updates, and category strategies shake out.

If I missed the last recompete, am I done at that customer?

No. Stay visible with end users, deliver value on current work, and bring your insight to primes holding the new channel. Your user intimacy and delivery record are your currency; trade them for meaningful workshare and new past performance on the vehicle that matters.

How to get ready—now

If you do nothing else this month, do these three things:

- Pick five: Choose five must-win accounts where you can credibly compete under consolidated channels in FY26. For each, write a one-page plan: target channel(s), access path (prime, JV, sub), three warm intros, and the first task order you will pursue.

Build two new partnerships: For each priority vehicle, identify two prime holders you can help win quickly. Bring a named end user, a “day-one” delivery plan, and a low-risk pricing approach. Then ask for a “quick win” project or pilot task order — a small, low-stakes piece of work that lets the prime demonstrate value to the buyer while giving you a chance to prove your reliability, responsiveness, and expertise. Examples include:

A short staff augmentation assignment

A limited technical study

A narrowly scoped helpdesk transition

A well-designed quick win lowers risk for everyone: the buyer sees results fast, the prime deepens their relationship with the agency, and you earn past performance that positions you for larger, follow-on work.

- Sharpen your offer: Codify one repeatable service package with a priced bill of materials, a three-page capability brief, and two mini case studies you can tailor and insert into your next RFI response.

🚀 Let’s Map Your Next Moves Together

Contract consolidation doesn’t have to be a cliff for small business—it can be a turn in the road. With the right moves, it can be an on-ramp to steadier pipelines and stronger partnerships.

Book a complimentary Federal Business Breakthrough Session with Summit Insight. In 30 minutes, we’ll:

✅ Identify how consolidation is reshaping your accounts

✅ Pinpoint the obstacles between you and new wins

✅ Map out immediate next steps to position and compete with confidence